January 2026 Market Report: Abbotsford & Chilliwack

Executive Summary: The "Real" Market Revealed

If you look at the headlines, you might see confusing signals. Some stats suggest balance, while others scream "volatility." However, when we strip away the seasonal noise and look at the 3-Month Trends, a clear picture emerges:

The Market is Softer than it Looks: By accounting for inventory fluctuations, we can see that Buyers currently have the upper hand in the Condo and Single Family markets in Abbotsford.

The "Golden Spread" is Real: For downsizers, the gap between selling a house and buying a townhome has never been more advantageous.

Investors are Back to Break-Even: The era of deep negative cashflow is close to ending, but profitable investing in 2026 requires a specific strategy.

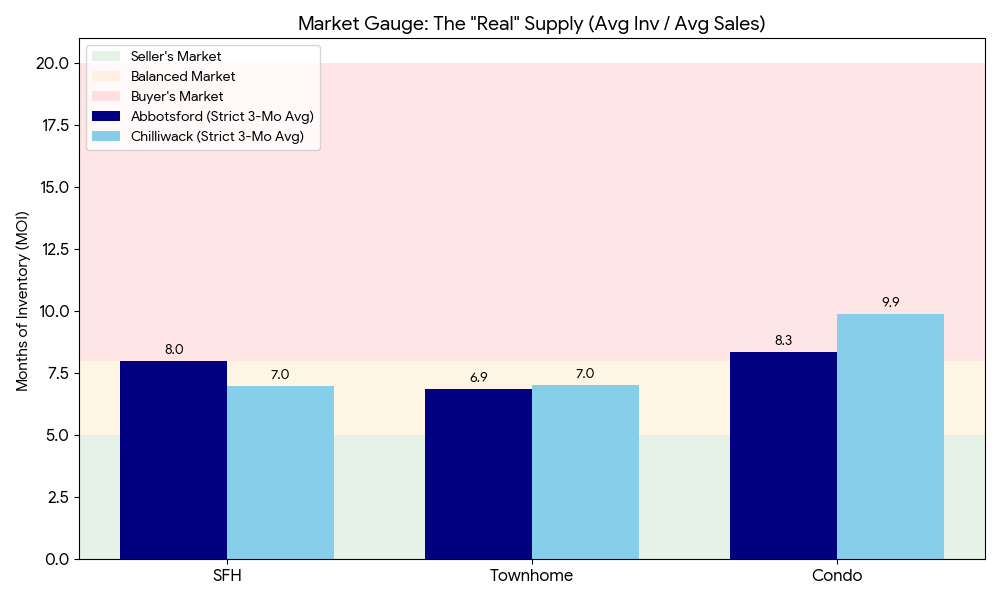

Market Gauge: The "Real" Supply Numbers

To get the most honest reading of the market, we calculated the Months of Inventory (MOI) using a strict 3-month average for both active listings and sales. This prevents the "December Dip" (when listings expire) from artificially making the market look tight.

0-5 Months: Seller's Market

5-8 Months: Balanced Market

8+ Months: Buyer's Market

Current Status (Jan 2026):

The Takeaway:

While Chilliwack houses remain balanced, the rest of the market—particularly Abbotsford—is softer than a simple snapshot suggests. Sellers in the 8+ MOI range are competing for fewer buyers and need to price sharply to generate traffic.

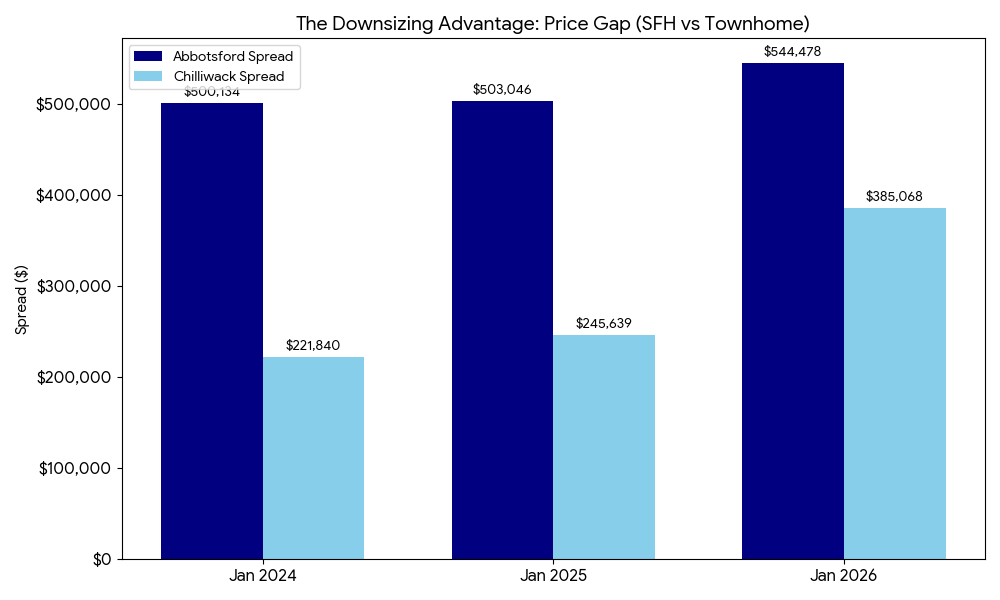

The Downsizing Bonus

If you have been waiting for the "perfect time" to downsize, the numbers suggest that time is now.

While home prices have softened across the board, they haven't dropped equally. The price of Townhomes has fallen faster than Detached Homes, widening the gap between the two.

The "Equity Unlock" Gap (Chilliwack Example):

Jan 2024: The spread was roughly $222,000.

Jan 2026: The spread is now roughly $385,000.

What this means:

Even though your home might sell for less today than at the peak, the townhome you are buying has dropped significantly more. By making the move today, you are effectively unlocking ~$160,000 MORE equity than if you had made the exact same move two years ago.

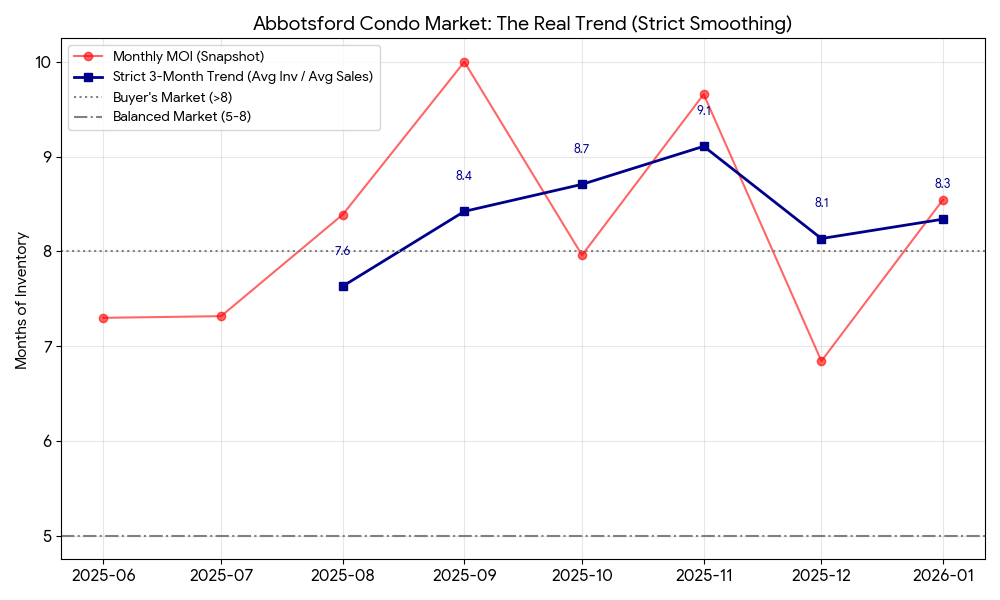

Spotlight: Abbotsford Condo Market

Status: Buyer's Market (8.3 Months of Supply)

Trend: Inventory is climbing while sales slow.

If you are selling a condo in Abbotsford right now, you might feel like the market has gone quiet. You are not imagining it.

November Reality: The market hit a wall with nearly 10 months of inventory.

The "False" December Dip: While stats looked tighter in December (due to listings expiring at year-end), the fundamental buyer demand didn't return.

January Reality: Inventory is climbing back up, and sales remain sluggish.

What this means for Sellers: The "Balanced Market" narrative is a lagging indicator. We are operating in a Buyer's Market. With over 8 months of supply, buyers can afford to be picky. To get showings, your listing needs to stand out as the compelling value option in its bracket.

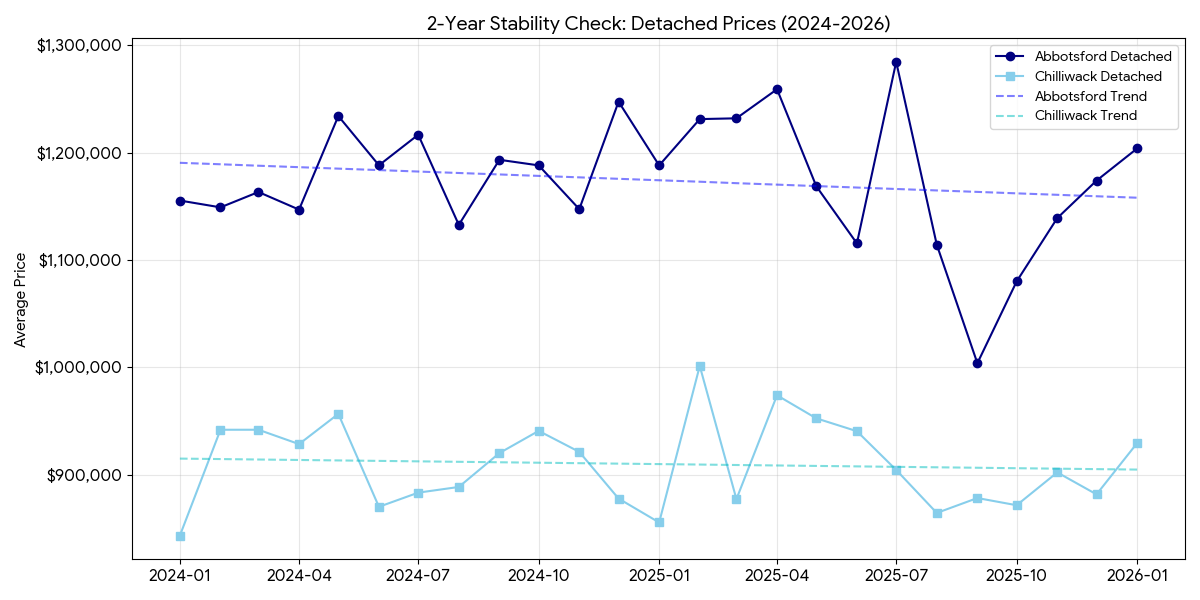

The "Stability" Trend (Last 2 Years)

Zooming out, the volatility of the COVID years has vanished. Looking at the trend line for the last 24 months (Jan 2024 – Jan 2026), the market has essentially flatlined.

Chilliwack Detached: Prices are stable (sideways movement).

Abbotsford Detached: Prices are flat (0-1% change).

Takeaway: We are in a period of "preservation." If you bought a home two years ago, your equity is safe. We aren't seeing wild appreciation, but we also aren't seeing the crashes predicted by the bears. This stability is healthy and allows for confident planning.

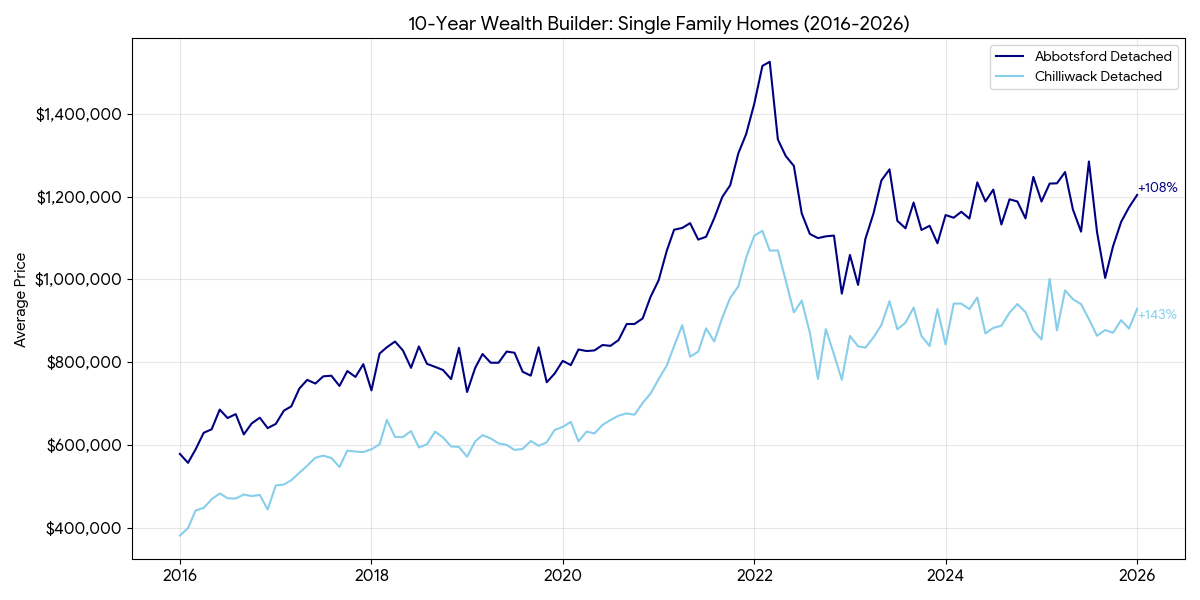

The "Wealth" Trend (10-Year View)

Real estate remains a long game. Despite the recent flat period, the 10-year trend line confirms that holding property in the Fraser Valley is a powerful wealth builder.

Chilliwack Detached Homes: 10-Year Trend Line Growth = ~11% per year.

Abbotsford Detached Homes: 10-Year Trend Line Growth = ~9% per year.

The Lesson: Time in the market beats timing the market. Even with the correction of 2022/2023 and the flatness of 2024/2025, long-term owners are sitting on massive gains.

Investors: The "Rate Sensitivity" Check

The biggest question we get is: "Do the numbers make sense again?"

The answer depends entirely on your interest rate. We ran the math on a typical 20% down payment scenario:

| Scenario | Cashflow Status |

| Rate @ 3.5% | Break-Even / Slightly Positive (+$30/mo) |

| Rate @ 4.0% | Slightly Negative (-$100/mo) |

| Rate @ 4.5% | Negative (-$250/mo) |

The Strategy for 2026:

Investors need to be rate-sensitive. If you can secure a variable rate in the mid-3% range, Abbotsford Townhomes and Condos are finally making sense again. If you are locking in closer to 4.5%, be prepared to contribute slightly to the monthly carry costs in exchange for buying at the market bottom.

Macro Outlook: Rates, Tariffs & The "Trump Effect"

Buyers are asking three main questions: "Where are rates going?," "What about the US?," and "Is my job safe?"

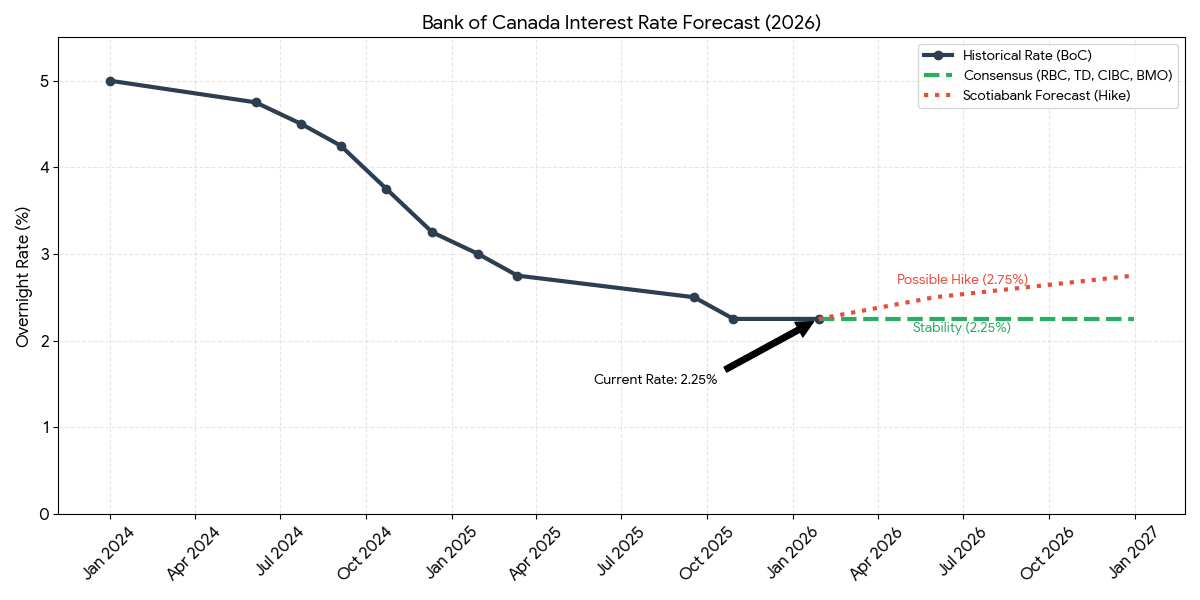

Interest Rates: Stability Returns

The Bank of Canada has held the policy rate at 2.25%, for the 3rd announcement in a row signalling a stability in interest rates.

This stability is giving buyers confidence to come off the sidelines. We aren't seeing the waiting for lower rates anymore; we are seeing a normalized borrowing environment.

The "Trump Effect" & Tariffs

With the new US administration threatening tariffs on Canadian goods (steel, aluminum, lumber), there is uncertainty in the economy. However, for real estate, this could have an ironic "bullish" side effect:

Higher Construction Costs: Tariffs make building new homes more expensive.

Supply Crunch: Developers may pause or cancel new projects due to these costs.

The Result: Existing homes become more valuable because they cannot be replaced at the old prices.

Consumer Sentiment:

Despite the trade noise, the local economy is holding firm.

Unemployment is Down: BC’s unemployment rate fell to 6.1% in January 2026.

Confidence is Up: With jobs secure and interest rates stable buyers are feeling confident enough to make long-term decisions again. They are cautious but active. The "wait and see" approach is fading as they realize that waiting for rates to drop further might just mean facing higher prices due to a lack of new supply.

Who Should Wait? (The Caution Zone)

While the market offers opportunities for many, two specific groups should exercise caution in 2026.

The "Stretch" Upsizer

If you are planning to sell a Townhome to buy a Detached House, be aware that the "bridge" has gotten longer. Because strata properties have softened faster than detached homes, the price gap you need to cover is significantly larger than it was in 2024.

Strategy: Run your numbers carefully. You may need a larger mortgage than expected to cover this widening spread.

The Short-Term Flipper

With prices trending flat (0-1% growth), there is no "market lift" to cover your transaction costs.

Strategy: Avoid speculative flips. In a stable market, real estate is a wealth preservation tool, not a get-rich-quick scheme.

What Should You Do?

Downsizers: This is your window. The math is overwhelmingly in your favor to trade a "high value" asset (House) for a "soft value" asset (Townhome/Condo).

First-Time Buyers: The Buyer's Market in Condos (Abbotsford & Chilliwack) is your best entry point in years. Take your time, negotiate hard, and don't fear the competition—there isn't much right now.

Sellers: Precision is key. In a market with 8 months of supply (Abbotsford), "testing the market" with a high price will result in stagnation. Pricing ahead of the curve is the only way to generate urgency.

Buying or Selling? Free home valuation and/or consultation

I look forward to working with you and helping you reach your home ownership goals. Reach out to get in touch and start the process today. I offer: